Affordability Education Gap Is No. 1 Barrier to Increasing Independent & Gig Worker Health Coverage Rate, Per New Stride Health Survey

As the leader in portable benefits technology, it's incredibly important that we fully understand the challenges, but also the opportunities for gig workers - including freelancers, consultants, 1099 workers and more - and their access to healthcare. Ahead of the 2023 Open Enrollment Period, a new survey we conducted demonstrates perceived affordability as the biggest barrier in getting independent and gig workers to enroll in healthcare coverage. The survey gathers information from more than 4,000 gig workers and digs into their perspective on healthcare, their finances and their outlook on work as we head into 2023.

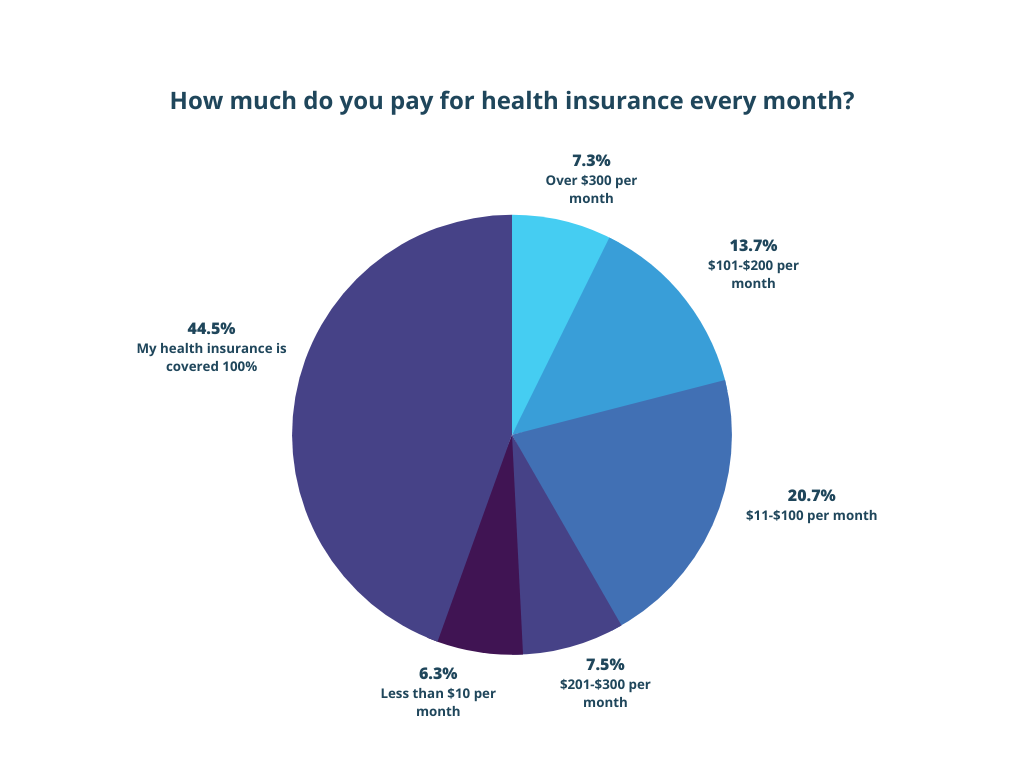

But with 72% of insured gig workers now covered for less than $100 per month — and 45% covered for $0 — we’re witnessing an education gap on the perception of insurance costs, rather than burdensome costs themselves.

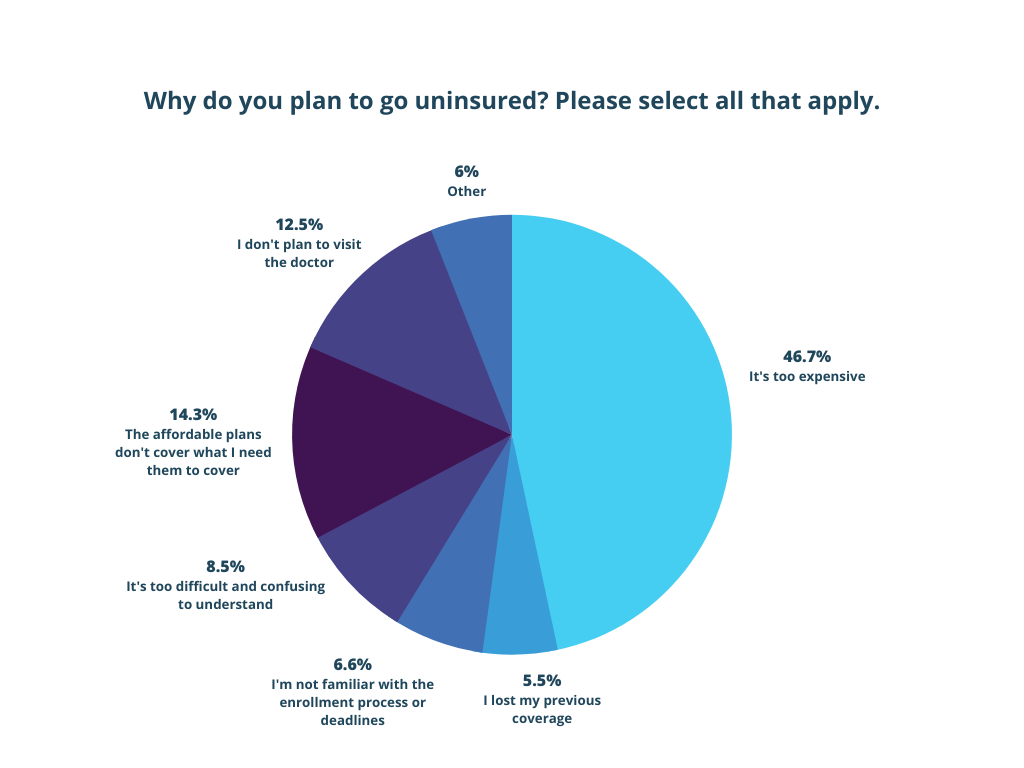

There is currently a massive education gap around affordability among non-benefited worker populations where nearly six in 10 uninsured workers think coverage is unaffordable and unattainable. However, with roughly half of those insured in that workforce paying $0 for that coverage.

The good news is that massive strides have been made as far as getting workers covered. In 2020, just 64% of gig workers said they would re-enroll in a new plan or keep their current healthcare coverage.

In 2022, that number jumps to 88% of gig workers who said they would re-enroll in a new plan or keep their current healthcare coverage. Only 12% of gig workers in 2022 said that they plan to go uninsured in 2023, setting up the country for another meaningful improvement in the uninsured rate.

However, we can’t rest on this progress: in January, the COVID-19 Public Health Emergency is ending and HHS estimates up to 15 million people will be disenrolled from Medicaid and the Children’s Health Insurance Program. Education, again, will be critical to ensure these Americans aren’t left without the coverage their families need.

According to our data, 18% of gig workers are currently covered by Medicare, which means these workers are at risk of losing insurance in that event. Many of them will need to look to the ACA markets for coverage for the 2023 calendar year, something they haven’t had to do for the past 2+ years as Medicare has simply rolled over.

The ACA has done wonders to ensure minority gig workers are protected, but there is still work left to do. Right now, Hispanic and Latino gig workers are the most likely to report not having insurance - 31% say they currently do not have health insurance. Gig workers that identify as Native American or Alaskan Native are second most likely to not have insurance, with 30% reporting a current lack of coverage.

However, amongst gig workers in all racial groups examined, more than half report feeling confident in their financial situation heading into 2023. Black and African American gig workers are the most confident, with 65% saying they feel optimistic about their finances heading into 2023.

And despite an ever-fluctuating and stressful economic environment, with peak inflation, markets down and layoffs taking over the news cycle, the job market is still strong and gig workers specifically are confident and satisfied. The overwhelming majority of gig workers report being happy with the work they do.

If interested in receiving more information on the survey data, please reach out to press@stridehealth.com.